B-2

(v) “Incentive Stock Option” means an Option intended to qualify as an incentive stock option within the meaning of Section 422(a) Any required approval of the Code.

(w) “Nonstatutory Stock Option” means an Option not intended to qualify as an Incentive Stock Option.

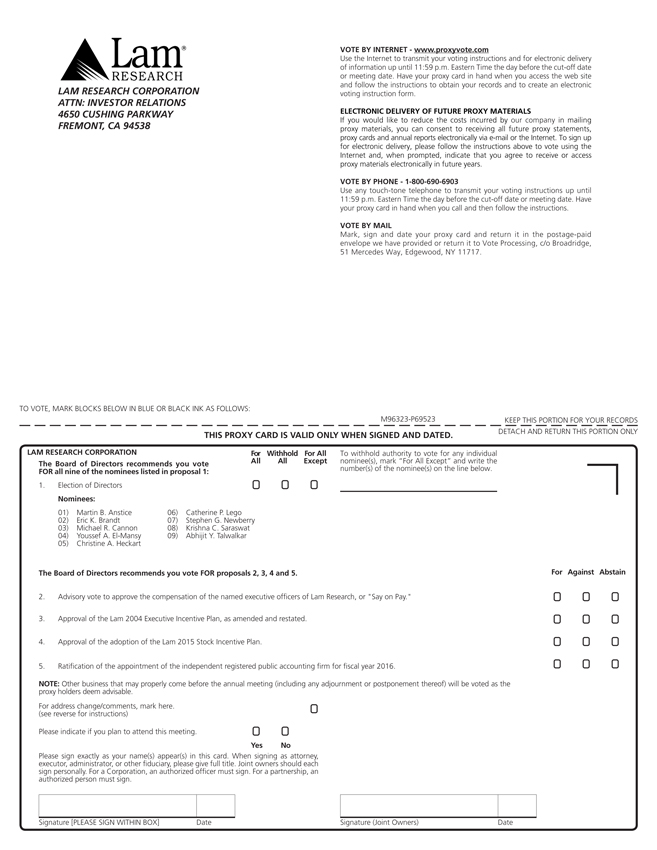

(x) “Officer” means a person who is an officerstockholders of the Company or a Related Entity within the meaningpursuant to paragraph 19(a) of this Plan shall be solicited substantially in accordance with Section 1614(a) of the Exchange Act and the rules and regulations promulgated thereunder.

(y) “Option” means an option to purchase Shares pursuant to an Award Agreement granted under the Plan.

(z) “Other Award” means an Award that may be denominated or payable in Shares or cash, including, but not limited to, purchase rights for Shares, the grant of Shares as a bonus, deferred Shares, performance Shares, phantom Shares, and other similar types of Awards, each with the terms and conditions as determined(b) If any required approval by the Committee pursuant to an Award Agreement.

(aa) “Outside Director” means a Director whostockholders of this Plan itself or of any amendment thereto is not an Employee.

(bb) “Parent” means a “parent corporation,” whether now or hereafter existing, as definedsolicited at any time otherwise than in the manner described in Section 424(e) of the Code.

(cc) “Performance-Based Compensation” means compensation qualifying as “performance-based compensation” under Section 162(m) of the Code.

(dd) “Plan” means this 2015 Stock Incentive Plan, as adopted by the Company.

(ee) “Related Entity” means any Parent, Subsidiary and any business, corporation, partnership, limited liability company or other entity in which21(a) hereof, then the Company a Parentshall, at or a Subsidiary holds a substantial ownership interest, directly or indirectly.

(ff) “Related Entity Disposition” meansbefore the sale, distribution or other disposition byfirst annual meeting of stockholders held after the Company, a Parent or a Subsidiarylater of all or substantially all(i) the first registration of the interestsany class of equity securities of the Company a Parent or a Subsidiary in any Related Entity effected by a sale, merger or consolidation or other transaction involving that Related Entity or the saleunder Section 12 of all or substantially all of the assets of that Related Entity, other than any Related Entity Disposition to the Company, a Parent or a Subsidiary.

(gg) “Restricted Stock” means Shares issued under the Plan to the Grantee for such consideration, if any, and subject to such restrictions on transfer, rights of first refusal, repurchase provisions, forfeiture provisions, and other terms and conditions as established by the Administrator.

(hh) �� “Restricted Stock Units” means an Award which may be earned in whole or in part upon the passage of time or the attainment of performance criteria established by the Administrator and which may be settled for cash, Shares or other securities or a combination of cash, Shares or other securities as established by the Administrator.

(ii) “Rule 16b-3” means Rule 16b-3 promulgated under the Exchange Act or any successor thereto.

(jj) “Share” means a share of(ii) the Common Stock.

(kk) “Stock Appreciation Right” means an Award to receive the appreciation in valuegranting of a Share from the date of grant until the time of exercise.

(ll) “Subsidiary” means a “subsidiary corporation,” whether now or hereafter existing, as defined in Section 424(f) of the Code.

3. Stock Subject to the Plan.

(a) Subject to the provisions as set forth in Section 10, below, the maximum aggregate number of Shares which may be issued pursuant to all Awards is 18,000,000 Shares, plus [ ] Shares (the number of Shares that remained available for grants under the Company’s 2007 Stock Incentive Plan (the “2007 Plan”) on November 4, 2015. In addition, any Shares that would otherwise return to the 2007 Stock Incentive Plan as a result of the forfeiture, termination or expiration of awards previously granted under the 2007 Plan as of November 4, 2015 (ignoring for this purpose the expiration of the 2007 Plan) shall become available under the Plan. The maximum aggregate number of Shares which may be issued pursuant to Incentive Stock Options is 18,000,000 Shares. Any Shares subject to Awards granted under the Plan other than Options and Stock Appreciation Rights shall be counted against the limit set forth herein as two (2) Shares for every one (1) Share subject to such

Continues on next page u

| | |

Lam Research Corporation 2015 Proxy Statement | | B-3 |

Award (and shall be counted as two (2) Shares for every one (1) Share returned to the Plan pursuant to Section 3(b), below). Options and Stock Appreciation Rights shall be counted against the limit set forth herein as one (1) Share subject to such Award (and shall be counted as one (1) Share returned to the Plan pursuant to Section 3(b), below). The Shares to be issued pursuant to Awards may be authorized, but unissued, or reacquired Common Stock.

(b) Any Shares covered by an Award (or portion of an Award) which is forfeited, canceled or expires (whether voluntarily or involuntarily) shall be deemed not to have been issued for purposes of determining the maximum aggregate number of Shares which may be issued under the Plan. Shares that actually have been issued under the Plan (e.g., Restricted Stock) pursuantPurchase Right hereunder to an Award shall not be returned to the PlanOfficer and shall not become available for future issuance under the Plan, except that if unvested Shares are forfeited, or repurchased by the Company at the lower of their original purchase price or their Fair Market Value at the time of repurchase,Director after such Shares shall become available for future grant under the Plan. Notwithstanding anything to the contrary contained herein: (i) Shares tendered or withheld in payment of an Option or Stock Appreciation Right exercise price shall not be returned to the Plan and shall not become available for future issuance under the Plan; and (ii) Shares withheld by the Company to satisfy any Option or Stock Appreciation Right tax withholding obligation shall not be returned to the Plan and shall not become available for future issuance under the Plan. Shares withheld by the Company to satisfy any tax withholding obligation for an Award other than for an Option or Stock Appreciation Right shall be returned to the Plan and shall become available for future issuance under the Plan.

4. Administration of the Plan.

(a) Plan Administrator.

(i) Administration with Respect to Directors and Officers. With respect to grants of Awards to Directors or Employees who are also Officers or Directors of the Company, the Plan shall be administered by (A) the Board or (B) a Committee designated by the Board, which Committee shall be constituted in such a manner as to satisfy the Applicable Laws and to permit such grants and related transactions under the Plan to be exempt from Section 16(b) of the Exchange Act in accordance with Rule 16b-3. Once appointed, such Committee shall continue to serve in its designated capacity until otherwise directed by the Board.

(ii) Administration With Respect to Consultants and Other Employees. With respect to grants of Awards to Employees or Consultants who are neither Directors nor Officers of the Company, the Plan shall be administered by (A) the Board or (B) a Committee that shall be constituted in such a manner as to satisfy the Applicable Laws. Once appointed, such Committee shall continue to serve in its designated capacity until otherwise directed by the delegating authority.

(iii) Administration With Respect to Covered Employees. Notwithstanding the foregoing, grants of Awards to any Covered Employee intended to qualify as Performance-Based Compensation shall be made only by a Committee (or subcommittee of a Committee) which is comprised solely of two or more Directors eligible to serve on a committee making Awards qualifying as Performance-Based Compensation. In the case of such Awards granted to Covered Employees, references to the “Administrator” or to a “Committee” shall be deemed to be references to such Committee or subcommittee.

(iv) Administration Errors. In the event an Award is granted in a manner inconsistent with the provisions of this subsection (a), such Award shall be presumptively valid as of its grant date to the extent permitted by the Applicable Laws.

(b) Powers of the Administrator. Subject to Applicable Laws and the provisions of the Plan (including any other powers given to the Administrator hereunder), and except as otherwise provided by the Board or the Compensation Committee, the Administrator shall have the authority, in its discretion:

(i) to select the Employees, Directors and Consultants to whom Awards may be granted from time to time hereunder;

(ii) to determine whether and to what extent Awards are granted hereunder;

(iii) to determine the number of Shares or the amount of other consideration to be covered by each Award granted hereunder;

(iv) to approve forms of Award Agreements for use under the Plan;

(v) to determine the terms and conditions of any Award granted hereunder;

B-4

(vi) to amend the terms of any outstanding Award granted under the Plan, provided that (A) no modification of any Award, even in the absence of an amendment, suspension, or termination of this Plan, shall impair any existing contractual rights of any Grantee unless (1) the affected Grantee consents to the amendment, suspension, termination, or modification or (2) no consent is required if the Board determines, in its sole and absolute discretion, that the amendment, suspension, termination, or modification: (a) is required or advisable in order for the Company, this Plan or the Award to satisfy Applicable Laws, to meet the requirements of any accounting standard or to avoid any adverse accounting treatment, or (b) in connection with any Corporate Transaction, is in the best interests of the Company or its stockholders; provided, however, that an amendment or modification that may cause an Incentive Stock Option to become a Non-Qualified Stock Option shall not be treated as adversely affecting the rights of the Grantee, (B) the reduction of the exercise price of any Option or Stock Appreciation Right awarded under the Plan shall be subject to stockholder approval, except in connection with an adjustment described in Sections 6(d), 10 or 11, and (C) canceling an Option or Stock Appreciation Right at a time when its exercise price exceeds the Fair Market Value of the underlying Shares, in exchange for another Option, Restricted Stock, Restricted Stock Unit, Stock Appreciation Right, Other Award or for cash shall be subject to stockholder approval, unless the cancellation and exchange occurs in connection with an adjustment described in Sections 6(d), 10 or 11;

(vii) to construe and interpret the terms of the Plan and Awards granted pursuant to the Plan, including without limitation, any notice of Award or Award Agreement, granted pursuant to the Plan;

(viii) to grant Awards to Employees, Directors and Consultants employed outside the United States on such terms and conditions different from those specified in the Plan as may, in the judgment of the Administrator, be necessary or desirable to further the purpose of the Plan; and

(ix) to take such other action, not inconsistent with the terms of the Plan, as the Administrator deems appropriate.

The express grant in the Plan of any specific power to the Administrator shall not be construed as limiting any power or authority of the Administrator; provided that the Administrator may not exercise any right or power reserved to the Board. Any decision made, or action taken, by the Administrator or in connection with the administration of this Plan shall be final, conclusive and binding on all persons having an interest in the Plan.

5. Eligibility. Awards other than Incentive Stock Options may be granted to Employees, Directors and Consultants of the Company and its Subsidiaries and Affiliates. Incentive Stock Options may be granted only to Employees of the Company, a Parent or a Subsidiary. An Employee who has been granted an Award may, if otherwise eligible, be granted additional Awards. Awards may be granted to such Employees who are residing in foreign jurisdictions as the Administrator may determine from time to time.

6. Terms and Conditions of Awards.

(a) Types of Awards. The Administrator is authorized under the Plan to award Options, Restricted Stock, Restricted Stock Units, Stock Appreciation Rights, and Other Awards with an exercise or conversion privilege related to the passage of time or Continuous Service, the occurrence of one or more events, or the satisfaction of performance criteria or other conditions as determined by the Administrator. The Administrator may provide for the payment of dividends or dividend equivalent rights in the terms of an Award, as evidenced in an Award Agreement. Such amounts may be paid in cash or additional Shares and may be subject to the same vesting restrictions as the underlying Award.

(b) Designation of Award. Each Award shall be designated in the Award Agreement. In the case of an Option, the Option shall be designated as either an Incentive Stock Option or a Nonstatutory Stock Option. However, notwithstanding such designation, an Option will qualify as an Incentive Stock Option under the Code only to the extent the $100,000 dollar limitation of Section 422(d) of the Code is not exceeded. The $100,000 limitation of Section 422(d) of the Code is calculated based on the aggregate Fair Market Value of the Shares subject to Options designated as Incentive Stock Options which become exercisable for the first time by a Grantee during any calendar year (under all plans of the Company or any Parent or Subsidiary of the Company). For purposes of this calculation, Incentive Stock Options shall be taken into account in the order in which they were granted, and the Fair Market Value of the Shares shall be determined as of the grant date of the relevant Option. In the event that the Code or the regulations promulgated thereunder are amended after the date the Plan becomes effective to provide for a different limit on the Fair Market Value of the Shares permitted to be subject to Incentive Stock Options, then such different limit will be automatically incorporated herein and will apply to any Options granted after the effective date of such amendment.

Continues on next page u

| | |

Lam Research Corporation 2015 Proxy Statement | | B-5 |

(c) Conditions of Award. Subject to the terms of the Plan, the Administrator shall determine the provisions, terms, and conditions of each Award including, but not limited to, the Award vesting schedule, repurchase provisions, rights of first refusal, forfeiture provisions, form of payment (cash, Shares, or other consideration) upon settlement of the Award, payment contingencies, and satisfaction of any performance criteria. The performance criteria established by the Administrator may be based on any one of, or combination of, the following: (i) stock or market price; (ii) earnings per share; (iii) total shareholder value or return; (iv) operating margin (with or without regard to amortization/impairment of goodwill); (v) gross margin; (vi) return on equity or average shareholder’s equity; (vii) return on assets or net assets; (viii) return on investment; (ix) income; (x) net income; (xi) operating income; (xii) net operating income; (xiii) pre-tax profit; (xiv) cash flow (including free cash flow); (xv) revenue; (xvi) expenses; (xvii) earnings (including special or extraordinary items); (xviii) earnings before taxes; (xix) earnings before interest and taxes; (xx) net earnings; (xxi) earnings before interest, taxes and depreciation; (xxii) economic value added; (xxiii) market share; (xxiv) applications won; (xxv) controllable profits; (xxvi) customer satisfaction management by objectives; (xxvii) individual management by objectives; (xxviii) product or technological developments; (xxix) net income; (xxx) orders (whether new or not); (xxxi) pro forma net income; (xxxii) asset turnover; (xxxiii) minimum cash balances; (xxxiv) return on sales; (xxxv) return on capital or invested capital; (xxxvi) operational performance; (xxxvii) backlog; (xxxviii) deferred revenue; (xxxix) revenue per employee; (xxxx) overhead; (xxxxi) days sales outstanding; (xxxxii) inventory turns; (xxxxiii) operating cash flow; and (xxxxiv) strategic plan development and implementation (including individually designed goals and objectives that are consistent with the Grantee’s specific duties and responsibilities and that are designed to improve the organizational performance of the Company, an affiliate, or a specific business unit thereof and that are consistent with and derived from the strategic operating plan of the Company, an affiliate or any of their business units for the applicable performance period). For Awards that are not intended to qualify as Performance-Based Compensation, the performance criteria established by the Administrator may be based on personal management objectives, or other measures of performance selected by the Administrator. The level or levels of performance specified with respect to a performance goal may be GAAP or non-GAAP measures (and may, without limitation, appropriately adjust any evaluation of performance under the business criteria to exclude any of the following events that occurs during a performance period: (A) asset write-downs; (B) litigation or claim judgments or settlements; (C) the effect of changes in tax law, accounting principles or other such laws or provisions affecting reported results; (D) accruals for reorganization and restructuring programs; and (E) any extraordinary non-recurring items as described in FASB Accounting Standards Codification 225 and/or in management’s discussion and analysis of financial condition and results of operations appearing in the Company’s annual report to stockholders for the applicable year) as determined by the Administrator and may be established in absolute terms, as objectives relative to performance in prior periods, as an objective compared to the performance of one or more comparable companies or an index covering multiple companies, or otherwise as the Administrator may determine. The performance criteria may be applicable to the Company, Related Entities and/or any individual business units of the Company or any Related Entity, including on a pro forma basis. Partial achievement of the specified criteria may result in a payment or vesting corresponding to the degree of achievement as specified in the Award Agreement.

(d) Acquisitions and Other Transactions. The Administrator may issue Awards under the Plan in the assumption, conversion, or in substitution, of outstanding awards in connection with the Company or a Related Entity acquiring another entity, an interest in another entity or an additional interest in a Related Entity whether by merger, stock purchase, asset purchase or other form of transaction. Any Shares that are issued in such circumstances will not reduce the number of Shares available for issuance under the Plan or otherwise count against the limits contained in Sections 6(g) or 6(m).

(e) Deferral of Award Payment. The Administrator may establish one or more programs under the Plan to permit selected Grantees the opportunity to elect to defer receipt of consideration upon exercise of an Award, satisfaction of performance criteria, or other event that absent the election would entitle the Grantee to payment or receipt of Shares or other consideration under an Award. The Administrator may establish the election procedures, the timing of such elections, the mechanisms for payments of, and accrual of interest or other earnings, if any, on amounts, Shares or other consideration so deferred, and such other terms, conditions, rules and procedures that the Administrator deems advisable for the administration of any such deferral program.

(f) Separate Programs. The Administrator may establish one or more separate programs under the Plan for the purpose of issuing particular forms of Awards to one or more classes of Grantees on such terms and conditions as determined by the Administrator from time to time.

(g) Limitations on Awards. The following limitations apply to Awards.

(i) Individual Limit for Options. The maximum number of Shares with respect to which Options and Stock Appreciation Rights may be granted to any Grantee in any fiscal year of the Company shall be 1,000,000 Shares. Notwithstanding anything herein to the contrary, the maximum number of Shares with respect to which Options and Stock Appreciation

B-6

Rights may be granted to any Grantee which a new Employee in the fiscal year in which he or she commences employment shall be 2,000,000 Shares. The foregoing limitations shall be adjusted proportionately in connection with any change in the Company’s capitalization pursuant to Section 10, below. To the extent required by Section 162(m) of the Code or the regulations thereunder, in applying the foregoing limitations with respect to a Grantee, if any Option or Stock Appreciation Right is canceled, the canceled Option or Stock Appreciation Right shall continue to count against the maximum number of Shares with respect to which Options and Stock Appreciation Rights may be granted to the Grantee.

(ii) Individual Limit for Restricted Stock, Restricted Stock Units, and Other Awards. For awards of Restricted Stock, Restricted Stock Units, and Other Awards intended to be Performance-Based Compensation under Section 162(m) of the Code, the maximum number of Shares with respect to which such Awards may be granted to any Grantee in any fiscal year of the Company shall be 600,000 Shares. The foregoing limitation shall be adjusted proportionately in connection with any change in the Company’s capitalization pursuant to Section 10, below.

(h) Deferral. If the vesting or receipt of Shares under an Award is deferred to a later date, any amount (whether denominated in Shares or cash) paid in addition to the original number of Shares subject to such Award will not be treated as an increase in the number of Shares subject to the Award if the additional amount is based either on a reasonable rate of interest or on one or more predetermined actual investments such that the amount payable by the Company at the later date will be based on the actual rate of return of a specific investment (including any decrease as well as any increase in the value of an investment).

(i) Early Exercise. The Award Agreement may, but need not, include a provision whereby the Grantee may elect at any time while an Employee, Director or Consultant to exercise any part or all of the Award prior to full vesting of the Award. Any unvested Shares received pursuant to such exercise may be subject to a repurchase right in favor of the Company or a Related Entity or to any other restriction the Administrator determines to be appropriate.

(j) Term of Award. The term of each Award shall be the term stated in the Award Agreement; provided, however, that the term shall be no more than ten (10) years from the date of grant thereof. However, in the case of an Incentive Stock Option granted to a Grantee who, at the time the Option is granted, owns stock representing more than ten percent (10%) of the voting power of all classes of stock of the Company or any Parent or Subsidiary of the Company, the term of the Incentive Stock Option shall be five (5) years from the date of grant thereof or such shorter term as may be provided in the Award Agreement. Notwithstanding the foregoing, the specified term of any Award shall not include any period for which the Grantee has elected to defer the receipt of the Shares or cash issuable pursuant to the Award.

(k) Vesting. The Award Agreement will specify the period or periods of Continuous Service necessary before the Award will vest, provided that no Award may vest sooner than the one year anniversary of the date of grant except with respect to five percent (5%) of the maximum aggregate number of Shares that may be issued pursuant to the Plan or as otherwise described in this subsection. An Award may provide for the earlier vesting of such an Award in specific circumstances, including (i) in the event of the death or Disability of a Grantee, or (ii) in the event of a Corporate Transaction or Related Entity Disposition where either (A) within a specified period the Grantee is involuntarily terminated for reasons other than for cause or terminates his or her employment for good reason or (B) such Awards are not assumed or converted into replacement awards as evidenced in the applicable Award Agreement.

(l) Transferability of Awards. Incentive Stock Options may not be sold, pledged, assigned, hypothecated, transferred, or disposed of in any manner other than by will or by the laws of descent or distribution and may be exercised, during the lifetime of the Grantee, only by the Grantee. Awards other than Incentive Stock Options shall be transferable (i) by will and by the laws of descent and distribution and (ii) during the lifetime of the Grantee, to the extent and in the manner authorized by the Administrator, but only to the extent such transfers are made to family members, to family trusts, to family controlled entities, to charitable organizations, and pursuant to domestic relations orders or agreements, in all cases without payment for such transfers to the Grantee. Notwithstanding the foregoing, the Grantee may designate one or more beneficiaries of the Grantee’s Award in the event of the Grantee’s death on a beneficiary designation form provided by the Administrator.

(m) Time of Granting Awards. The date of grant of an Award shall for all purposes be the date on which the Administrator makes the determination to grant such Award, or such other later date as is determined by the Administrator. Notice of the grant determination shall be given to each Employee, Director or Consultant to whom an Award is so granted within a reasonable time after the date of such grant.

Continues on next page u

| | |

Lam Research Corporation 2015 Proxy Statement | | B-7 |

(n) Limitations on Outside Director Awards. The following limitations apply to Awards made to Outside Directors.

(i) Individual Limit for Awards. The maximum number of Shares with respect to which Awards (whether Options, Restricted Stock, Restricted Stock Units, Stock Appreciation Rights, or Other Awards, or any combination therof) that may be granted to any Outside Director in any fiscal year of the Company shall be 80,000 Shares. The foregoing limitations shall be adjusted proportionately in connection with any change in the Company’s capitalization pursuant to Section 10, below.

(ii) Additional Option Limitations. For Options granted to any Outside Director, the term of any Option shall not exceed ten (10) years from the date of grant and the Exercise Price shall not be less than one hundred percent (100%) of the Fair Market Value per Share on the date of grant.

7. Award Exercise or Purchase Price, Consideration and Taxes.

(a) Exercise or Purchase Price. The exercise or purchase price, if any, for an Award shall be as follows:

(i) In the case of an Incentive Stock Option granted to an Employee who, at the time of the grant of such Incentive Stock Option owns stock representing more than ten percent (10%) of the voting power of all classes of stock of the Company or any Parent or Subsidiary, the per Share exercise price shall be not less than one hundred ten percent (110%) of the Fair Market Value per Share on the date of grant.

(ii) In cases other than the case described in the preceding paragraph, the per Share exercise price of an Option or Stock Appreciation Right shall be not less than one hundred percent (100%) of the Fair Market Value per Share on the date of grant.

(iii) In the case of Awards intended to qualify as Performance-Based Compensation, the exercise or purchase price, if any, shall be not less than one hundred percent (100%) of the Fair Market Value per Share on the date of grant.

(iv) In the case of a Restricted Stock, Restricted Stock Unit, or Other Award grant, such price, if any, shall be determined by the Administrator.

(v) Notwithstanding the foregoing provisions of this Section 7(a), in the case of an Award issued pursuant to Section 6(d), above, the exercise or purchase price for the Award shall be determined in accordance with the provisions of the relevant instrument evidencing the agreement to issue such Award.

(b) Consideration. Subject to Applicable Laws, the consideration to be paid for the Shares to be issued upon exercise or purchase of an Award including the method of payment, shall be determined by the Administrator (and, in the case of an Incentive Stock Option, shall be determined at the time of grant). In addition to any other types of consideration the Administrator may determine, the Administrator is authorized to accept as consideration for Shares issued under the Planregistration, do the following:

| | (i) | cash;furnish in writing to the holders entitled to vote for this Plan substantially the same information that would be required (if proxies to be voted with respect to approval or disapproval of this Plan or amendment were then being solicited) by the rules and regulations in effect under Section 14(a) of the Exchange Act at the time such information is furnished; and |

| | (ii) | check;file with, or mail for filing to, the Securities and Exchange Commission four copies of the written information referred to in subsection (i) hereof not later than the date on which such information is first sent or given to stockholders. |

(iii) surrender

| 22. | Conditions upon Issuance of Shares. |

(a) Shares or delivery of a properly executed form of attestation of ownership of Shares as the Administrator may require (including withholding of Shares otherwise deliverable upon exercise of the Award) which have a Fair Market Value on the date of surrender or attestation equal to the aggregate exercise price of the Shares as to which said Award shall not be exercised (but only to the extent that such exercise of the Award would not result in an accounting compensation chargeissued with respect to the Shares used to paya Purchase Right unless the exercise price unless otherwise determined by the Administrator);

(iv) with respect to Options, payment through a broker-dealer sale and remittance procedure pursuant to which the Grantee (A) shall provide written (or electronic) instructions to a Company designated brokerage firm to effect the immediate sale of some or all of the purchased Shares and remit to the Company sufficient funds to cover the aggregate exercise price payable for the purchased Shares and (B) shall provide written directives to the Company to deliver the certificates for the purchased Shares directly to such brokerage firm in order to complete the sale transaction;

(v) with respect to Options, payment through a “net exercise” such that, without the payment of any funds, the Grantee may exercise the Option and receive the net number of Shares equal to (i) the number of Shares as to which the Option is being exercised, multiplied by (ii) a fraction, the numerator of which is the Fair Market Value per Share (on such date as is

B-8

determined by the Administrator) less the Exercise Price per Share,Purchase Right and the denominatorissuance and delivery of which is such Fair Market Value per Share (the numbershares pursuant thereto shall comply with all applicable provisions of net Shares to be received shall be rounded down to the nearest whole number of Shares);law, domestic or

(vi) any combination of the foregoing methods of payment.

The Administrator may at any time or from time to time, by adoption of or by amendment to the standard forms of Award Agreement described in Section 4(b)(iv), or by other means, grant Awards which do not permit all of the foregoing forms of consideration to be used in payment for the Shares or which otherwise restrict one or more forms of consideration.

(c) Taxes. No Shares shall be delivered under the Plan to any Grantee or other person until such Grantee or other person has made arrangements acceptable to the Administrator for the satisfaction of any foreign, federal, state, or local income and employment tax withholding obligations, including, without limitation, obligations incident to the receiptSecurities Act of Shares. Upon exercise or vesting1933, as amended, the Securities Exchange Act of an Award,1934, as amended, the Company shall withhold or collect from Grantee an amount sufficient to satisfy such tax obligations, including, but not limited to, by surrenderrules and regulations promulgated thereunder, and the requirements of the whole number of Shares covered by the Award sufficient to satisfy the minimum applicable tax withholding obligations incident to the exercise or vesting of an Award.

8. Exercise of Award.

(a) Procedure for Exercise; Rights as a Stockholder.

(i) Any Award granted hereunder shall be exercisable at such times and under such conditions as determined by the Administrator under the terms of the Plan and specified in the Award Agreement.

(ii) An Award shall be deemed to be exercised when written or electronic notice of such exercise has been given to the Company or Company designated brokerage firm in accordance with the terms of the Award by the person entitled to exercise the Award and full payment for the Shares with respect toany stock exchange upon which the Award is exercised has been made, including, to the extent selected, use of the broker-dealer sale and remittance procedure to pay the purchase price as provided in Section 7(b)(iv).

(iii) Exercise of Award Following Termination of Continuous Service.

(A) An Awardshares may notthen be exercised after the termination date of such Award set forth in the Award Agreement and may be exercised following the termination of a Grantee’s Continuous Service only to the extent provided in the Award Agreement.

(B) Where the Award Agreement permits a Grantee to exercise an Award following the termination of the Grantee’s Continuous Service for a specified period, the Award shall terminate to the extent not exercised on the last day of the specified period or the last day of the original term of the Award, whichever occurs first.

(C) Any Award designated as an Incentive Stock Option to the extent not exercised within the time permitted by law for the exercise of Incentive Stock Options following the termination of a Grantee’s Continuous Service shall convert automatically to a Nonstatutory Stock Option and thereafter shall be exercisable as such to the extent exercisable by its terms for the period specified in the Award Agreement.

9. Conditions Upon Issuance of Shares.

(a) If at any time the Administrator determines that the delivery of Shares pursuant to the exercise, vesting or any other provision of an Award is or may be unlawful under Applicable Laws, the vesting or right to exercise an Award or to otherwise receive Shares pursuant to the terms of an Award shall be suspended until the Administrator determines that such delivery is lawfullisted, and shall be further subject to the approval of counsel for the Company with respect to such compliance. The Company shall have no obligation to effect any registration or qualification of the Shares under federal, state or applicable non-U.S. laws.

(b) As a condition to the exercise of an Award,a Purchase Right, the Company may require the person exercising such AwardPurchase Right to represent and warrant at the time of any such exercise that the Sharesshares are being purchased only for investment and without any present intention to sell or distribute such Sharesshares if, in the opinion of counsel for the Company, such a representation is required by any Applicable Laws.

Continues on next page uof the aforementioned applicable provisions of law.

| 23. | | |

Lam Research Corporation 2015 Proxy Statement | | B-9Term of Plan. |

10. Adjustments Upon Changes in Capitalization. Subject to any required action by the stockholders of the Company and Section 11 hereof, the number of Shares covered by each outstanding Award, and the number of Shares which have been authorized for issuance under theThis Plan but as to which no Awards have yet been granted or which have been returned to the Plan, the exercise or purchase price of each such outstanding Award, the maximum number of Shares with respect to which Awards may be granted to any Grantee in any fiscal year of the Company, as well as any other terms that the Administrator determines require adjustment shall be proportionately adjusted for (i) any increase or decrease in the number of issued Shares resulting from a stock split, reverse stock split, stock dividend, combination or reclassification of the Shares, or similar event affecting the Shares, (ii) any other increase or decrease in the number of issued Shares effected without receipt of consideration by the Company, or (iii) any other transaction with respect to Common Stock including a corporate merger, consolidation, acquisition of property or stock, separation (including a spin-off or other distribution of stock or property), reorganization, liquidation (whether partial or complete) or any similar transaction; provided, however that conversion of any convertible securities of the Company shall not be deemed to have been “effected without receipt of consideration.” In the event of any distribution of cash or other assets to stockholders other than a normal cash dividend, the Administrator shall also make such adjustments as provided in this Section 10 or substitute, exchange or grant Awards to effect such adjustments (collectively “adjustments”). Any such adjustments to outstanding Awards will be effected in a manner that precludes the enlargement of rights and benefits under such Awards. In connection with the foregoing adjustments, the Administrator may, in its discretion, prohibit the exercise of Awards or other issuance of Shares, cash or other consideration pursuant to Awards during certain periods of time. Except as the Administrator determines, no issuance by the Company of shares of any class, or securities convertible into shares of any class, shall affect, and no adjustment by reason hereof shall be made with respect to, the number or price of Shares subject to an Award.

11. Corporate Transactions and Related Entity Dispositions. Except as may be provided in an Award Agreement:

(a) In the event of a Corporate Transaction, any or all outstanding Awards shall be subject to the definitive agreement governing the Corporate Transaction. Such transaction agreement may provide, without limitation and in a manner that is binding on all parties, for (A) the assumption, substitution or replacement with equivalent awards of outstanding Awards (but in each case adjusted to reflect the transaction terms) by the surviving corporation or its parent, (B) continuation of outstanding Awards (but again adjusted to reflect the transaction terms) by the Company if the Company is a surviving corporation, (C) accelerated vesting, or lapse of repurchase rights or forfeiture conditions applicable to, and accelerated expiration or termination of, the outstanding Awards, or (D) settlement of outstanding Awards (including termination thereof) in cash. Except for adjustments to reflect the transaction terms as referenced above or, to the extent any Award or Shares are subject to accelerated vesting or lapse of restrictions approved by the Board or Committee upon specific events or conditions (and then only to the extent such acceleration benefits are reflected in the transaction agreement, the applicable Award Agreement or another written agreement between the participant and the Company), any outstanding Awards that are assumed, substituted, replaced with equivalent awards or continued shall continue following the transaction to be subject to the same vesting or other restrictions that applied to the original Award. The Administrator need not adopt the same rules or apply the same treatment for each Award or Grantee.

(b) Notwithstanding anything herein to the contrary, in the event of a dissolution or liquidation of the Company, to the extent an Award has not been exercised or the Shares subject thereto have not been issued in full prior to the earlier of the completion of the transaction or the applicable expiration date of the Award, then outstanding Awards shall terminate immediately prior to the transaction.

(c) Any Incentive Stock Option accelerated under this Section 11 in connection with a Corporate Transaction or Related Entity Disposition shall remain exercisable as an Incentive Stock Option under the Code only to the extent the $100,000 dollar limitation of Section 422(d) of the Code is not exceeded. To the extent such dollar limitation is exceeded, the accelerated excess portion of such Option shall be exercisable as a Nonstatutory Stock Option.

12. Effective Date and Term of Plan. The Plan shall become effective on November [4], 2015. It shall continue in effect for a term of ten (10)10 years from its effective date(until August 28, 2028), pursuant to an amendment and restatement by the Board of Directors on August 29, 2018, unless sooner terminated. Subjectterminated under Section 19 hereof.

| 24. | Additional Restrictions of Rule16b-3. |

The terms and conditions of Purchase Rights granted hereunder to, and the purchase of shares by, persons subject to Section 17, below, and Applicable Laws, Awards may be granted under the Plan upon its becoming effective.

13. Amendment, Suspension or Termination16 of the Plan.

(a) The Board may at any time amend, suspend or terminateSecurities Exchange Act of 1934 shall comply with the Plan;provided,however, that noapplicable provisions of Rule16b-3 of such amendmentAct. This Plan shall be made withoutdeemed to contain, and such Purchase Rights shall contain, and the approval of the Company’s stockholders to the extent such approval is required by Applicable Laws, or if such amendment would:

(i) lessen the stockholder approval requirements of Section 4(b)(vi) or this Section 13(a), which, except in connection with the adjustments described in Sections 6(d), 10 or 11, are intended to prevent (A) the repricing of “underwater”

B-10

Options and Stock Appreciation Rights by reducing theshares issued upon exercise price of an Option or Stock Appreciation Right and (B) the cancellation of an Option or Stock Appreciation Right in exchange for cash, another Award, or an Option or Stock Appreciation Right with a lower exercise price;

(ii) increase the benefits accrued to participants under the Plan;

(iii) increase the number of securities which may be issued under the Plan; or

(iv) modify the requirements for participation in the Plan.

(b) No Award may be granted during any suspension of the Plan or after termination of the Plan.

(c) No suspension or termination of the Plan (including termination of the Plan under Section 11 above) shall adversely affect any rights under Awards already granted to a Grantee which, regardless of any suspension or termination, shall continue to be subject to the terms of the Plan.

14. Reservation of Shares.

(a) The Company, during the term of the Plan, will at all times reserve and keep available such number of Shares as shall be sufficient to satisfy the requirements of the Plan.

(b) The inability of the Company to obtain authority from any regulatory body having jurisdiction, which authority is deemed by the Company’s counsel to be necessary to the lawful issuance and sale of any Shares hereunder, shall relieve the Company of any liability in respect of the failure to issue or sell such Shares as to which such requisite authority shall not have been obtained.

15. No Effect on Terms of Employment/Consulting Relationship. The Plan shall not confer upon any Grantee any right with respect to the Grantee’s Continuous Service, nor shall it interfere in any way with his or her right or the right of the Company or any Related Entity to terminate the Grantee’s Continuous Service at any time, with or without cause.

16. No Effect on Retirement and Other Benefit Plans. Except as specifically provided in a retirement or other benefit plan of the Company or a Related Entity, Awards shall not be deemed compensation for purposes of computing benefits or contributions under any retirement plan of the Company or a Related Entity, and shall not affect any benefits under any other benefit plan of any kind or any benefit plan subsequently instituted under which the availability or amount of benefits is related to level of compensation. The Plan is not a “Pension Plan” or “Welfare Plan” under the Employee Retirement Income Security Act of 1974, as amended.

17. Stockholder Approval. The grant of Incentive Stock Options under the Planthereof shall be subject to, approvalsuch additional conditions and restrictions as may be required by Rule16b-3 to qualify for the stockholdersmaximum exemption from Section 16 of the Company within twelve (12) months before or after the date the Plan is adopted excluding Incentive Stock Options issued in substitution for outstanding Incentive Stock Options pursuant to Section 424(a) of the Code. Such stockholder approval shall be obtained in the degree and manner required under Applicable Laws.

18. Plan History. On May 14, 2015, the Board adopted, and on August 26, 2015, the Board amended, the Plan, effective as of the date of stockholder approval, which occurred on November [4], 2015 (the “Effective Date”). No grants will be made on or after the Effective Date under the 2007 Plan or the Company’s 2011 Stock Incentive Plan (as amended), except that outstanding awards under these predecessor plans will continue unaffected following the Effective Date and will continue to be subject to the terms of the applicable predecessor plan regardless of the termination of such predecessor plan with regard to new grants.

19. Unfunded Obligation. Grantees shall have the status of general unsecured creditors of the Company. Any amounts payable to Grantees pursuant to the Plan shall be unfunded and unsecured obligations for all purposes, including, without limitation, Title I of the Employee Retirement Income SecuritySecurities Exchange Act of 1974, as amended. Neither the Company nor any Related Entity shall be required to segregate any monies from its general funds, or to create any trusts, or establish any special accounts1934 with respect to such obligations. The Company shall retain at all times beneficial ownership of any investments, including trust investments, which the Company may make to fulfill its payment obligations hereunder. Any investments or the creation or maintenance of any trust or any Grantee account shall not create or constitute a trust or fiduciary relationship between the Administrator, the Company or any Related Entity and a Grantee, or otherwise create any vested or beneficial interest in any Grantee or the Grantee’s creditors in any assets of the Company or a Related Entity. The Grantees shall have no claim against the Company or any Related Entity for any changes in the value of any assets that may be invested or reinvested by the Company with respect to the Plan.Plan transactions.